The Green Technology Revolution

The UK is totally dependent on tin imports, of which 75% come from Asia (mainly China, Indonesia, Myanmar), which can involve low ethics in production, exploitation of workers, and high carbon emissions…

…but there is a better way.

Cornish Tin Limited is helping to drive the development of Green Mining in Cornwall and the UK.

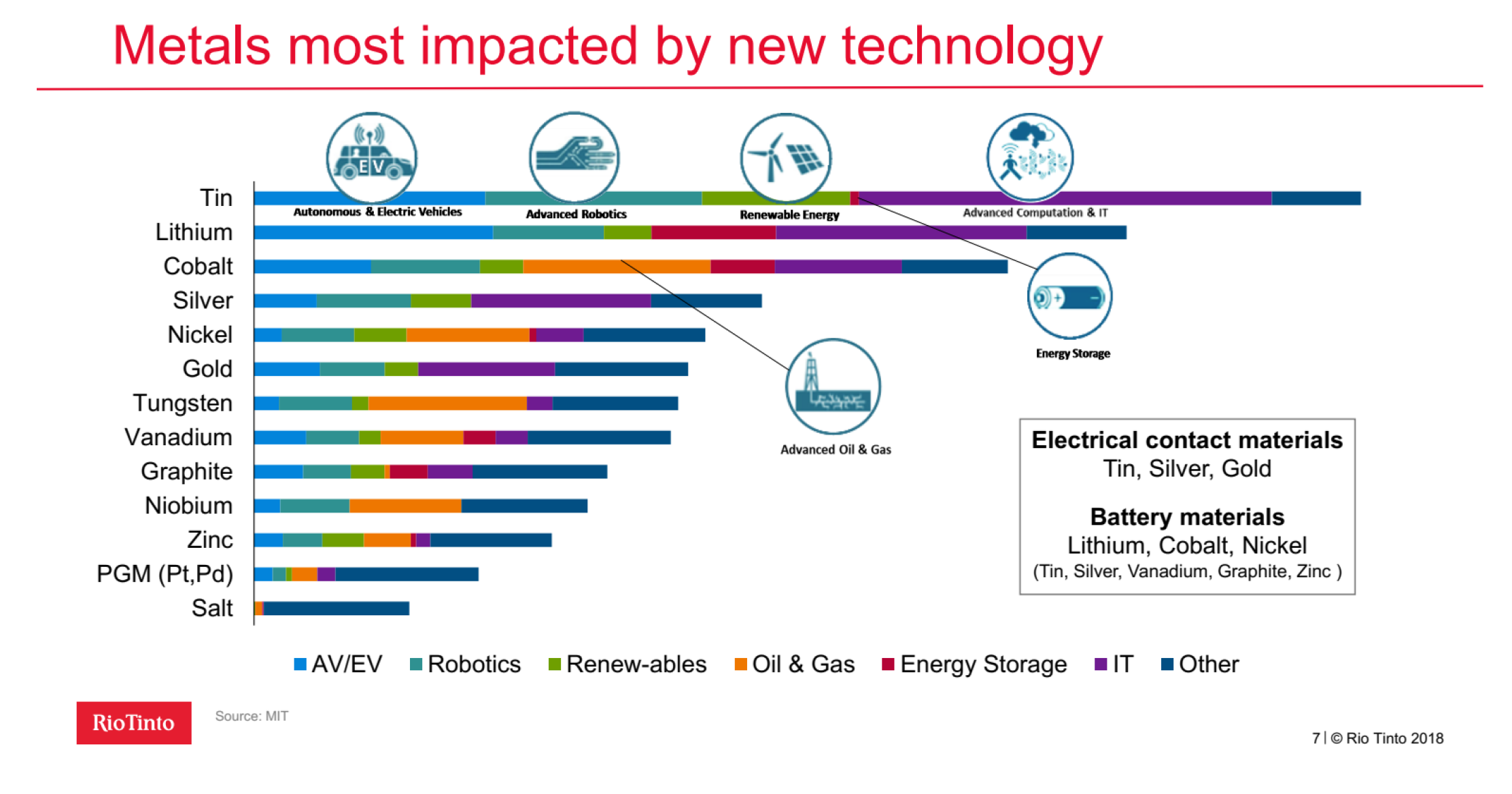

Our green future needs sustainably mined resources, and MIT predictions put tin at the top of the list of metals needed for the green technology revolution, with lithium a close second.

Tin and lithium are essential to build and power new generation technology. Cornwall has important domestic resources and can mitigate total UK dependence on tin and lithium imports.

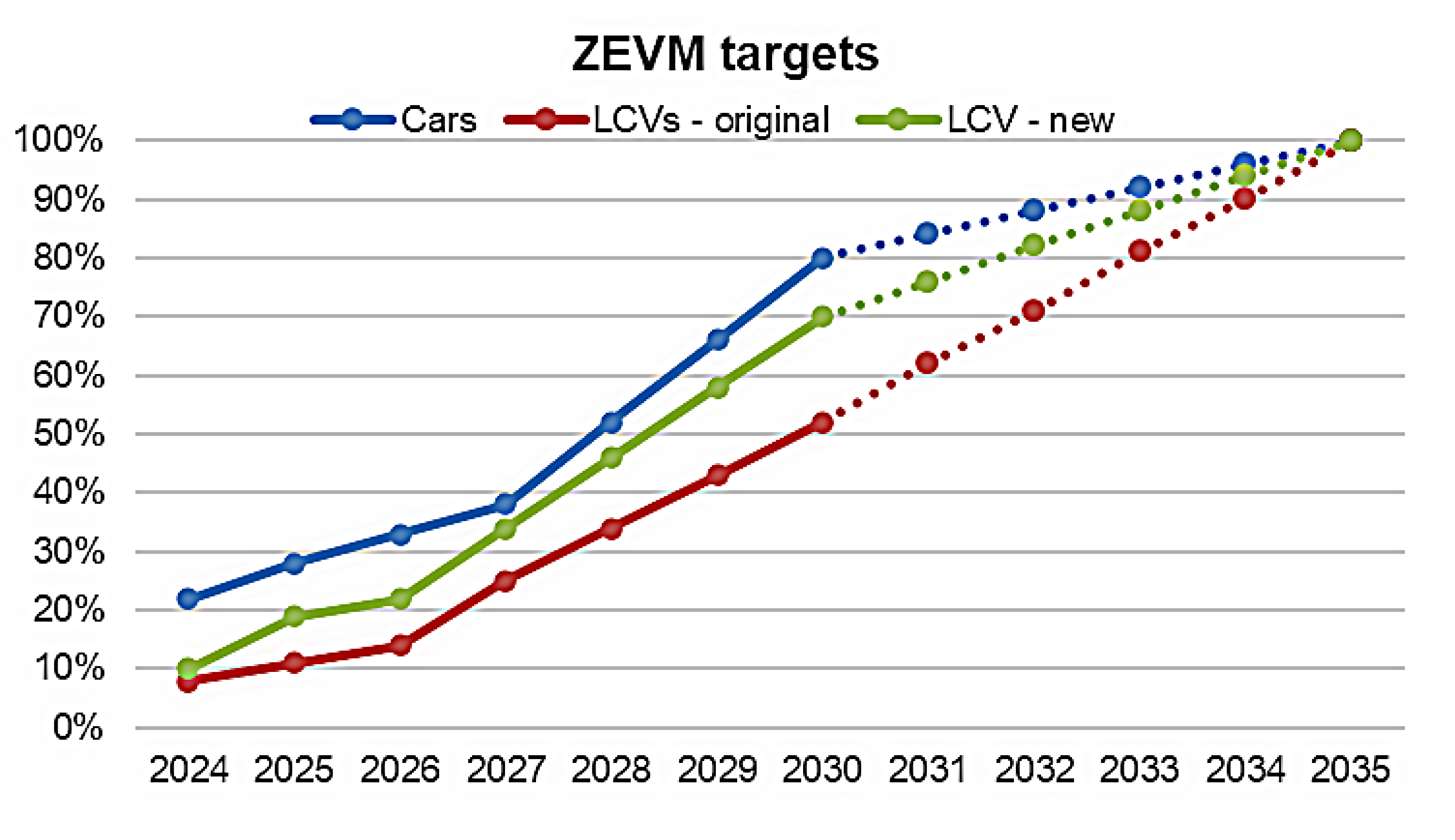

UK Government target of net-zero vehicle emissions by 2040 is increasing the demand for tin.

"Around half of all tin used globally goes into soldering circuit-boards, the hidden drivers of the electronic world, meaning it is everywhere but nowhere to be seen.

The metal may not grab the headlines in the same way as cobalt or lithium, but electric vehicles aren't leaving the garage without it." Reuters 19 May 2021

Tin Market Overview

Most Impacted Metal by Technology

Massachusetts Institute of Technology (MIT) analysis for Rio Tinto in 2018 identified tin as the metal most likely to be positively impacted by the electric vehicle and energy storage revolution, with other key drivers of demand being advanced robotics, computation, climate change and the Technology of Things.

Upward Pressure on Tin Price

The global tin market is relatively small, at approx 395,000 tonnes in 2022. The demand for tin is predicted to increase by up to 40% by 2030. Lack of investment in new tin projects in the last decade means future supply deficits. Supply disruptions have a major impact on the tin price.

Technology Supercycle Driving a Global Surge in Demand For Tin

ITA New Technologies Report 2020 also predicted theTECHNOLOGY SUPERCYCLE which is now driving a surge in global demand for tin as a necessary component in many developing green technologies for sustainable power generation, notably advances in solar power.

Increasing Demand in Conventional Applications

In addition to the disruptive effect on the tin market caused by new technologies, there is stable demand and historic steady growth at 2% to 3% pa in conventional applications,including electronic and industrial solder, chemicals, tinplate, float glass, brass and bronze.

Global Demand Forecast to Outstrip Supply

Thin supply pipeline: depletion of existing mine reserves and recent lack of investment in early stage exploration projects indicate that global supply is unlikely to keep pace with future demand.Forecasters expect ongoing increasing deficits, with demand continuing to increase and global supply continuing to fall, unless new production comes on stream.

Cornwall ready to re-take its position as Europe’s leading tin producer

There is no primary tin production in Europe. Tin is designated as a critical metal for the UK, and a robust domestic supply is imperative. Cornwall is well placed through the tonnage and high grades of its tin resources to re-take its former position as Europe’s leading tin producing area.

Lithium Market Overview

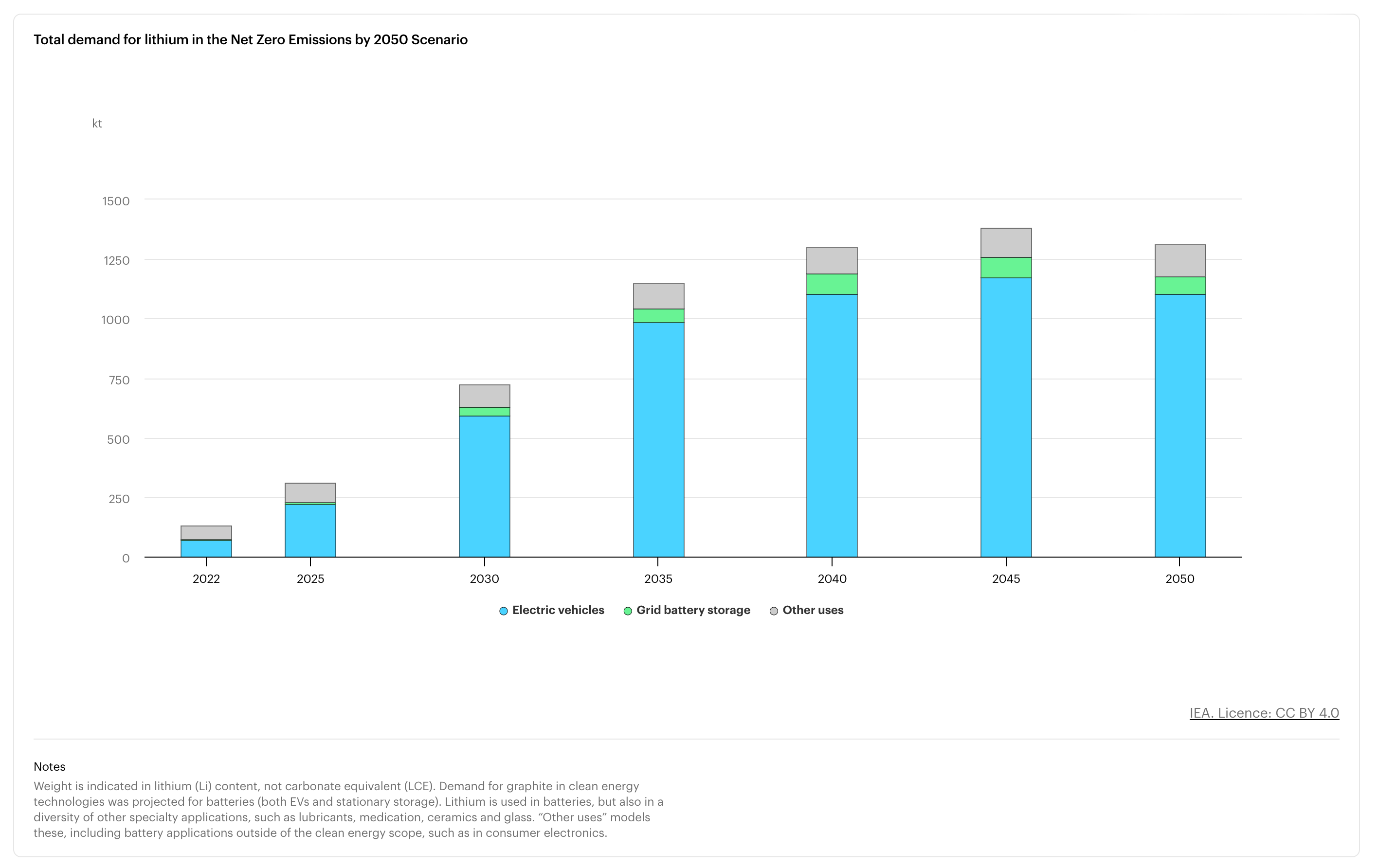

The lithium market is set for explosive growth, driven by surging electric vehicle deployment

The International Energy Agency has confirmed that lithium demand for clean energy technologies is growing at the fastest pace among major minerals. While other minerals used in EVs (e.g. cobalt, nickel) are subject to uncertainty around different chemistry choices, lithium demand is relatively immune to these risks, with additional upsides if all-solid-state batteries are widely adopted. Clean energy technologies represented around 30% of total lithium demand in 2021 (up from a minuscule share in 2010), and the rapid uptake of EV deployment raises the share to some 75% in the STEPS and over 90% in the SDS by 2040.

IEA (2021), The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions, License: CC BY 4.0

Currently, all the UK’s lithium is imported. Our world is one of conflict and aggressive political disruption of the supply chains of critical minerals. It is imperative that the UK secures its own domestic supply for UK industry of the critical minerals without which it cannot operate. The UK automotive industry, with a turnover of over £60 billion in 2020, supports approx 800,000 jobs.

Source: SMMT

The post-Brexit Rules of Origin require increasing targets of components by value of electric vehicles to be UK or EU sourced, to avoid tariffs on exports of electric vehicles to the EU. The automotive sector in the UK is implementing an ambitious ramp up of EV manufacture to meet the Zero Emission Vehicle Mandate. The UK needs approx 80,000 tones per annum of lithium carbonate equivalent (LCE) by 2030.

Source: UK Critical Minerals Intelligence Centre

Subscribe For News Updates

Stay up to date with the latest news straight to your inbox.

We take your privacy seriously, you can unsubscribe at any time.